Your Dependent care benefits w2 images are available in this site. Dependent care benefits w2 are a topic that is being searched for and liked by netizens today. You can Download the Dependent care benefits w2 files here. Find and Download all free vectors.

If you’re searching for dependent care benefits w2 images information related to the dependent care benefits w2 topic, you have come to the right blog. Our site frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

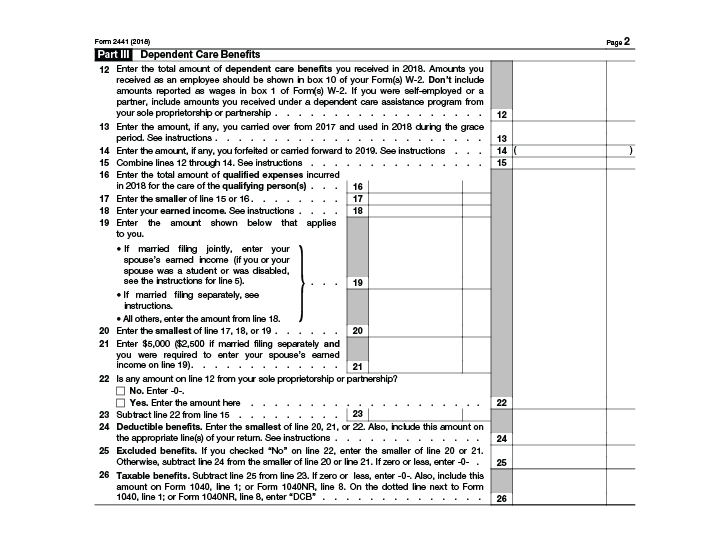

Dependent Care Benefits W2. The amount entered on screen w2, located under the income folder, in the dependent care benefits field is used in the calculation of form 2441. I�m working through turbotax, and it�s saying that since we didn�t spend at least $10,500 on our dependent that we don�t get the child and dependent care credit. The credit applicable to the dependent care. Under the american rescue plan act (arpa), employers had the option to allow a temporary increase in dependent care contributions for the 2021 plan year.

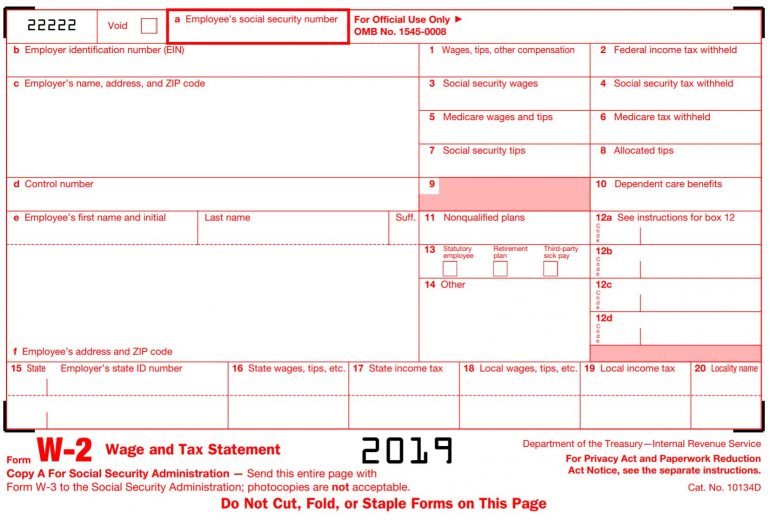

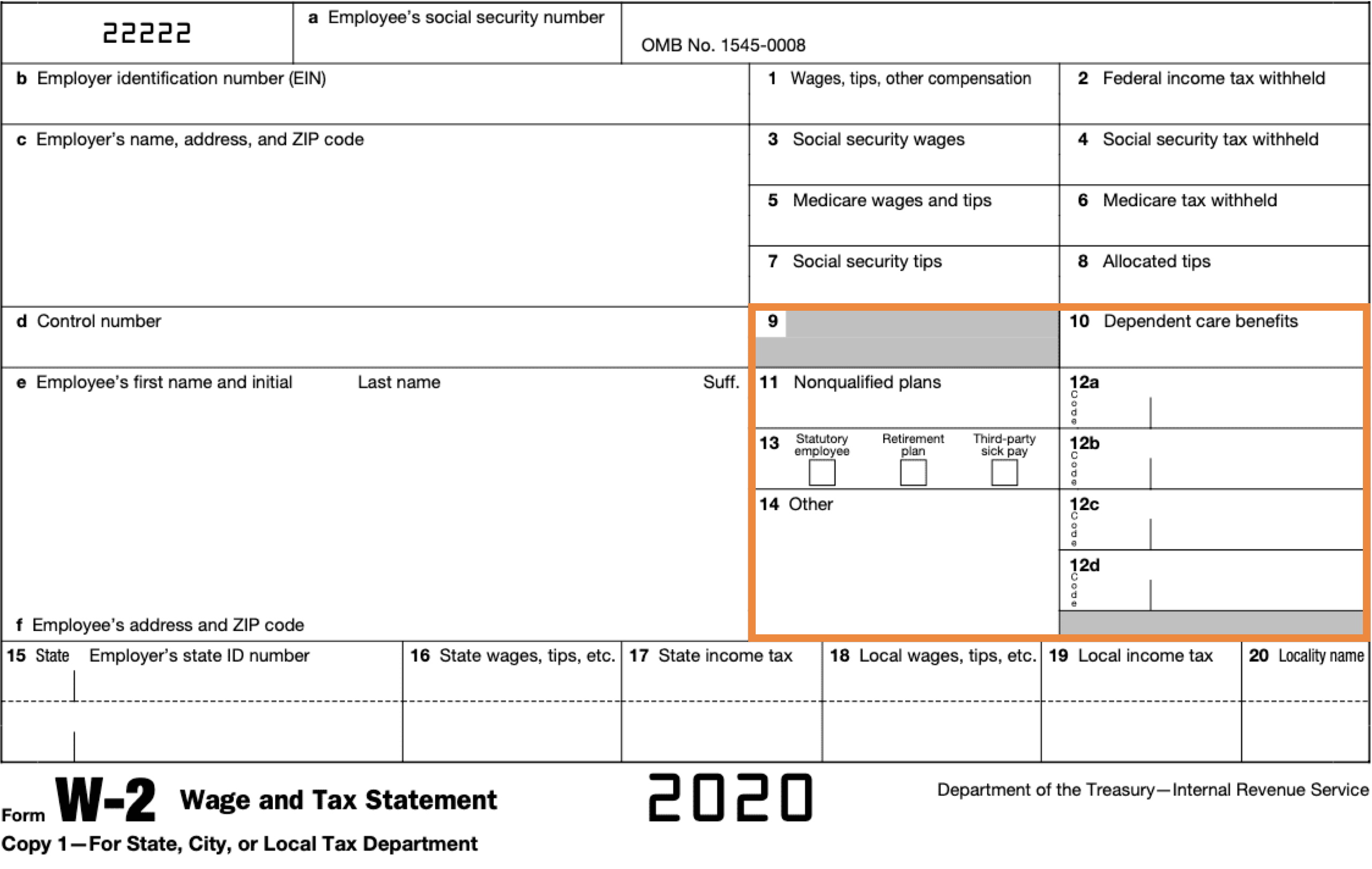

What Is Form W2? An Employer�s Guide to the W2 Tax Form From gusto.com

What Is Form W2? An Employer�s Guide to the W2 Tax Form From gusto.com

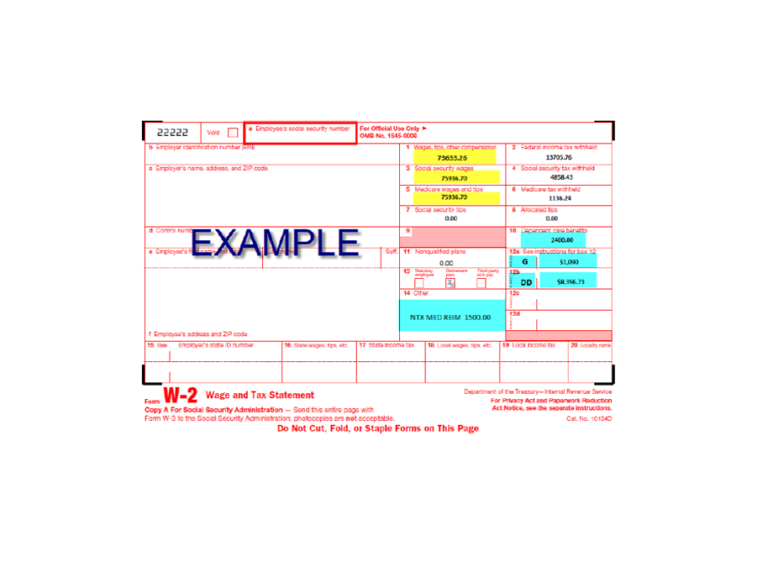

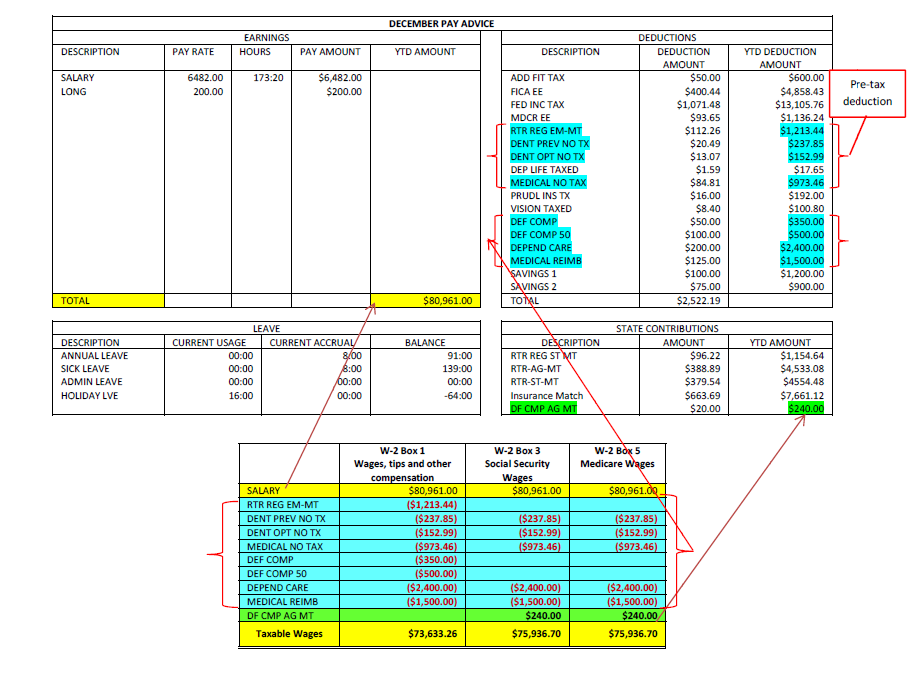

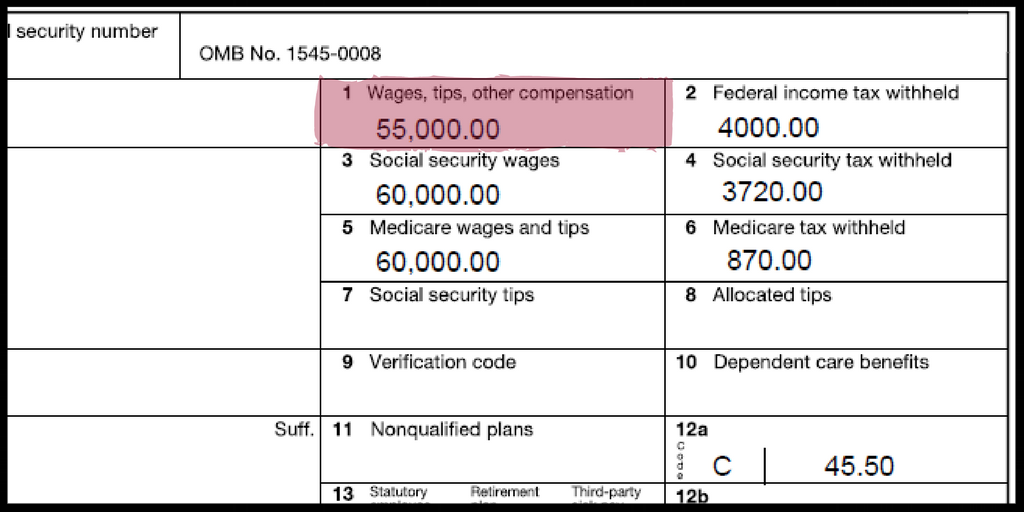

There are several types of compensation and benefits that can be reported in box 12. The amount entered on screen w2, located under the income folder, in the dependent care benefits field is used in the calculation of form 2441. I have dependent care benefits in my w2 but i did not use the benefit. My understanding is that if you contribute to a dependent care fsa (is that the same as dcap?) it will appear in box 10 of your w2. The rules state that a married filing separate spouse can only contribute $2500. I�m working through turbotax, and it�s saying that since we didn�t spend at least $10,500 on our dependent that we don�t get the child and dependent care credit.

The instructions for box 10 say report all amounts paid or incurred (regardless of any employee forfeitures).

If you had any type of fsa other than dependent care, you can file your taxes without worrying about it. Any amount reported in box 10 reduces or eliminates. Dependent care benefits include dependent care tax credits, paid leave for the care of dependents, and flexible spending accounts for dependent care. Complete form 2441, child and dependent care expenses, to figure any taxable and nontaxable amounts.” to: Subtract the box 10 amount from the amount. Dependent care benefits refer to specific benefits that are provided by employers to their employees in the care of their dependents.

Source: nerdwallet.com

Source: nerdwallet.com

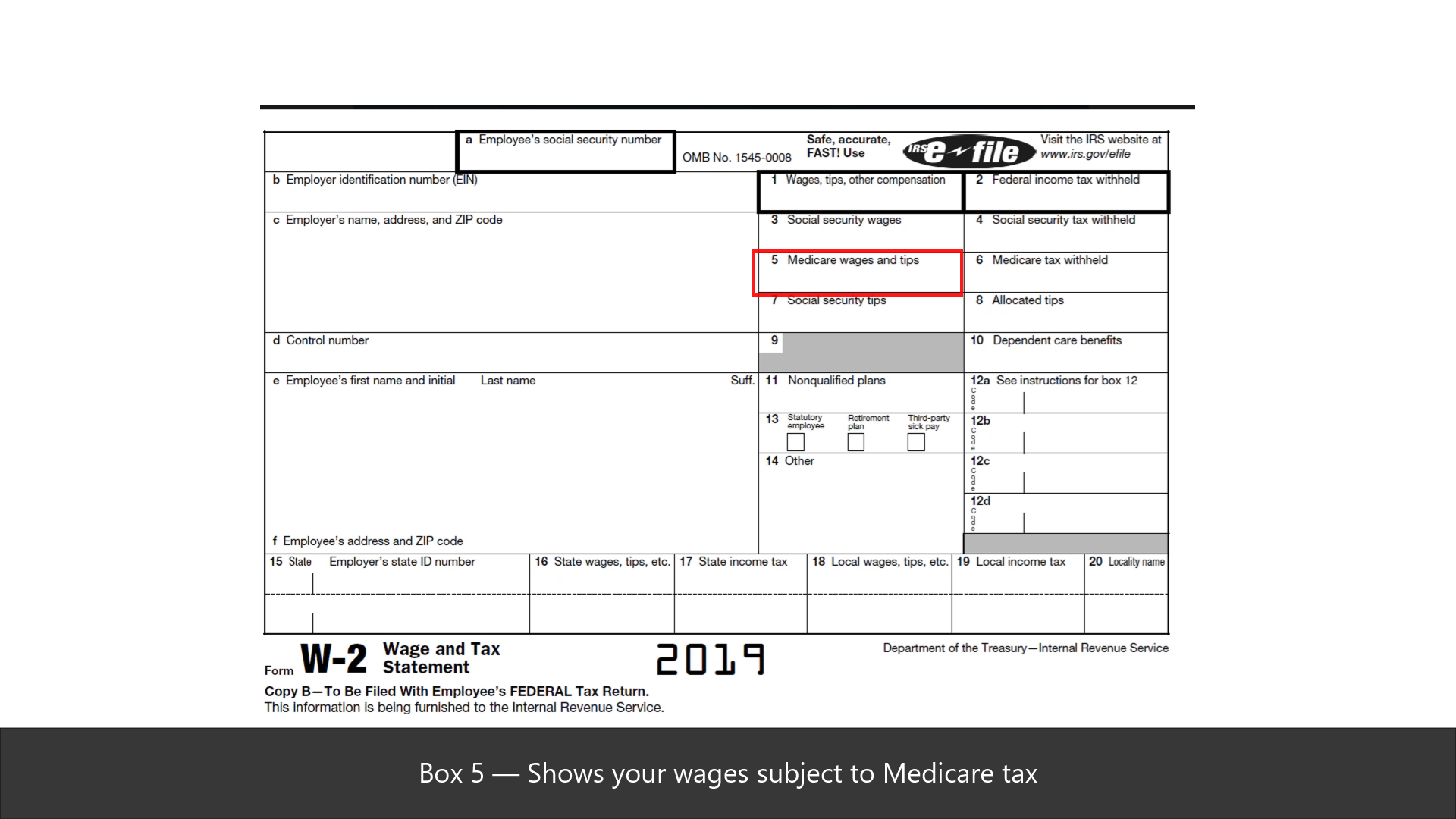

Dependent care benefits are under a bigger umbrella of employee benefits system administered by the internal revenue service (irs). This deduction is already reflected in box 1. There are several types of compensation and benefits that can be reported in box 12. Box 10 dependent care benefits: For 2021, the arp increased to $10,500 (previously $5,000) the maximum amount that can be excluded from an employee�s income through a dependent care assistance.

Source: remotefinancialplanner.com

Source: remotefinancialplanner.com

This box shows the number of dependent care benefits you elected. The maximum amount of $5,000 was increased to $10,500. Such benefits may take the form of childcare tax credits or a dependent care. The contribution is from employer. Dependent care benefits include dependent care tax credits, paid leave for the care of dependents, and flexible spending accounts for dependent care.

Source: slideserve.com

Source: slideserve.com

If an amount is entered in this field and form 2441 information has not been entered on screen cr , located under the credits folder, the amount will be reported as a taxable dependent care benefits on form 1040, line 1. Such benefits may take the form of childcare tax credits or a dependent care. The contribution is from employer. Subtract the box 10 amount from the amount. Complete form 2441, child and dependent care expenses, to figure any taxable and nontaxable amounts.” to:

Source: gusto.com

Source: gusto.com

There are several types of compensation and benefits that can be reported in box 12. I have a client with dependent care benefits in box 10 of his w2 and it is better for him to file married filing separately. Dependent care benefits are available to individuals whose children are cared for by a daycare facility or provider. This box shows the number of dependent care benefits you elected. Arpa increased the maximum amount of dependent care benefits that can be excluded from an employee’s income from $5,000 to $10,500 for most taxpayers.

Source: sao.wyo.gov

Source: sao.wyo.gov

That makes sense to me. Dependent care benefits are available to individuals whose children are cared for by a daycare facility or provider. The amount entered on screen w2, located under the income folder, in the dependent care benefits field is used in the calculation of form 2441. The instructions for box 10 say report all amounts paid or incurred (regardless of any employee forfeitures). I�m working through turbotax, and it�s saying that since we didn�t spend at least $10,500 on our dependent that we don�t get the child and dependent care credit.

Source: signnow.com

Source: signnow.com

The maximum amount of $5,000 was increased to $10,500. This box shows the number of dependent care benefits you elected. Such benefits, up to a $5,000 limit, are also excluded from taxable income. Amounts over $10,500 ($5,250 in the case of a separate return filed by a married individual) are also included in box 1. There are several types of compensation and benefits that can be reported in box 12.

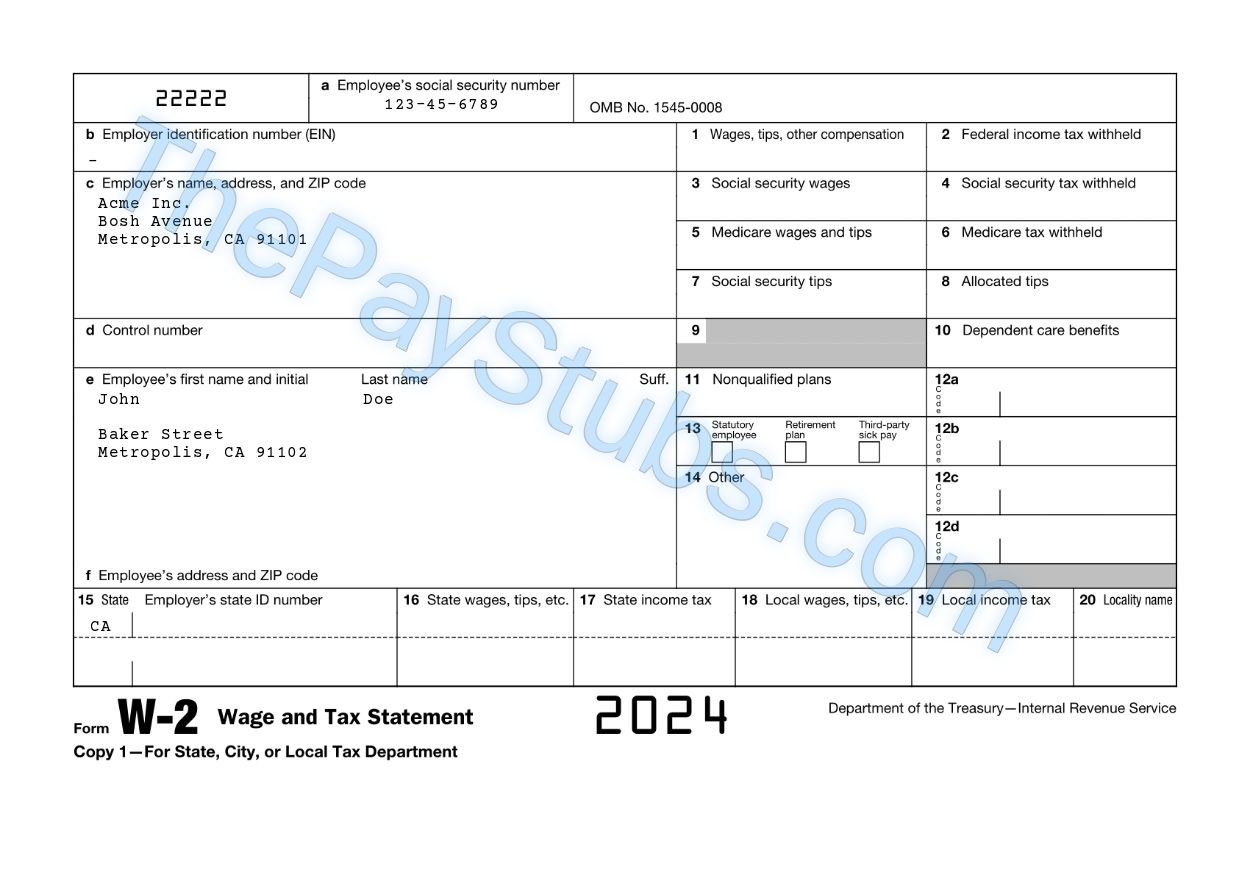

Source: thepaystubs.com

Source: thepaystubs.com

Hence, they can be claimed on the tax return. The maximum amount of $5,000 was increased to $10,500. Such benefits, up to a $5,000 limit, are also excluded from taxable income. Under the american rescue plan act (arpa), employers had the option to allow a temporary increase in dependent care contributions for the 2021 plan year. The credit applicable to the dependent care.

Source: library.myguide.org

Source: library.myguide.org

I have dependent care benefits in my w2 but i did not use the benefit. I have a client with dependent care benefits in box 10 of his w2 and it is better for him to file married filing separately. Cafeteria plan health care flexible spending accounts (also called “medical This box shows the number of dependent care benefits you elected. The instructions for box 10 say report all amounts paid or incurred (regardless of any employee forfeitures).

Source: paystubs365.com

Source: paystubs365.com

Under the american rescue plan act (arpa), employers had the option to allow a temporary increase in dependent care contributions for the 2021 plan year. Dependent care benefits refer to specific benefits that are provided by employers to their employees in the care of their dependents. Subtract the box 10 amount from the amount. Dependent care benefits are available to individuals whose children are cared for by a daycare facility or provider. Dependent care dcfsas (also called “dependent care accounts” or dcas)— must be reported.

Source: sao.wyo.gov

Source: sao.wyo.gov

Dependent care benefits are under a bigger umbrella of employee benefits system administered by the internal revenue service (irs). This box shows the number of dependent care benefits you elected. Dependent care benefits include dependent care tax credits, paid leave for the care of dependents, and flexible spending accounts for dependent care. Deferred compensation and other compensations. Dependent care benefits (w2) benefits that are offered by employers to the employee(s) so that they can take care of their dependents are called dependent care benefits.

Source: jdunman.com

Source: jdunman.com

If an amount is entered in this field and form 2441 information has not been entered on screen cr , located under the credits folder, the amount will be reported as a taxable dependent care benefits on form 1040, line 1. Complete form 2441, child and dependent care expenses, to figure any taxable and nontaxable amounts.” to: Hence, they can be claimed on the tax return. Dependent care benefits refer to specific benefits that are provided by employers to their employees in the care of their dependents. Dependent care benefits (w2) benefits that are offered by employers to the employee(s) so that they can take care of their dependents are called dependent care benefits.

Source: smartasset.com

Source: smartasset.com

If an amount is entered in this field and form 2441 information has not been entered on screen cr , located under the credits folder, the amount will be reported as a taxable dependent care benefits on form 1040, line 1. Any amounts over $5,000 are also included in boxes 1, 3, and 5. I have a client with dependent care benefits in box 10 of his w2 and it is better for him to file married filing separately. Any amount over $5,000 is also included in box 1. If an amount is entered in this field and form 2441 information has not been entered on screen cr , located under the credits folder, the amount will be reported as a taxable dependent care benefits on form 1040, line 1.

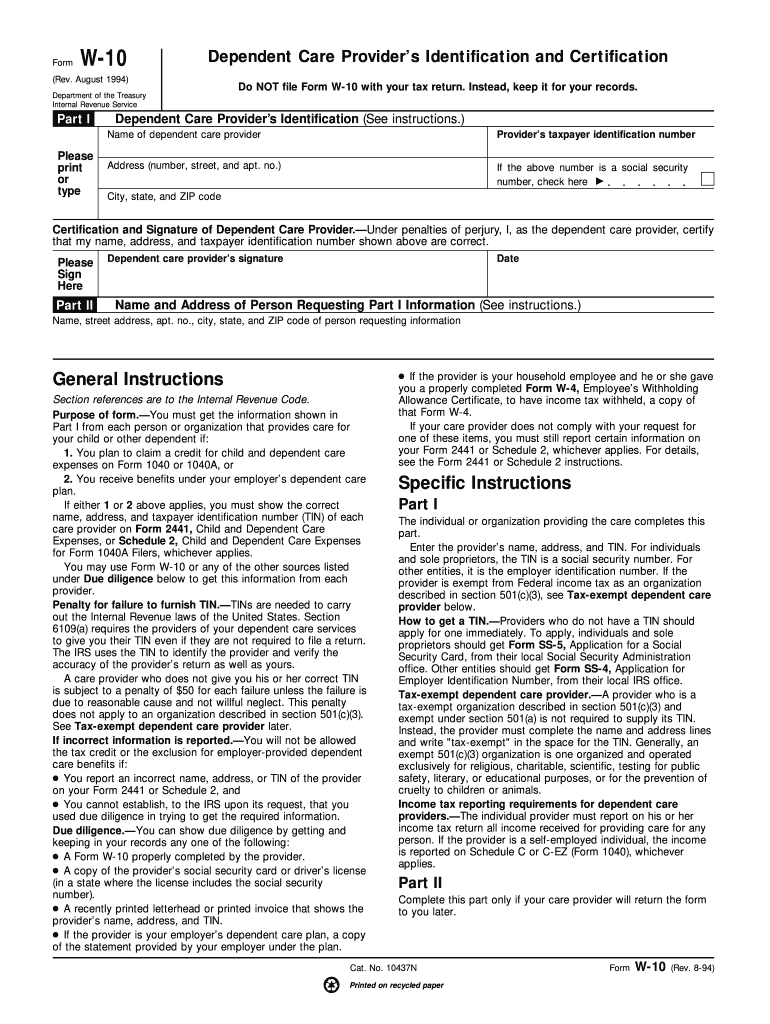

Source: apps.irs.gov

Source: apps.irs.gov

This deduction is already reflected in box 1. You can’t use expenses paid or reimbursed with these benefits to claim the childcare credit. The irs requires that you supply the amount contributed for the dependent care fsa in box 10. The credit applicable to the dependent care. Subtract the box 10 amount from the amount.

Source: help.onpay.com

Source: help.onpay.com

The credit applicable to the dependent care. My wife�s w2 lists us as having received $10,500 in dependent care benefits. Complete form 2441, child and dependent care expenses, to figure any taxable and nontaxable amounts.” to: “this amount includes the total dependent care benefits that your employer paid to you or incurred on your behalf (including amounts from a section 125 (cafeteria) plan). Subtract the box 10 amount from the amount.

Source: doctoredmoney.org

Source: doctoredmoney.org

Dependent care benefits are under a bigger umbrella of employee benefits system administered by the internal revenue service (irs). Dependent care dcfsas (also called “dependent care accounts” or dcas)— must be reported. Then, you will need to go through the dependent care section under deductions and credits. That makes sense to me. Deferred compensation and other compensations.

Source: wikihow.com

Source: wikihow.com

Hence, they can be claimed on the tax return. Under the american rescue plan act (arpa), employers had the option to allow a temporary increase in dependent care contributions for the 2021 plan year. Dependent care benefits (w2) benefits that are offered by employers to the employee(s) so that they can take care of their dependents are called dependent care benefits. Dependent care benefits are available to individuals whose children are cared for by a daycare facility or provider. For 2021, the arp increased to $10,500 (previously $5,000) the maximum amount that can be excluded from an employee�s income through a dependent care assistance.

Dependent care benefits refer to specific benefits that are provided by employers to their employees in the care of their dependents. Dependent care benefits include dependent care tax credits, paid leave for the care of dependents, and flexible spending accounts for dependent care. Amounts over $10,500 ($5,250 in the case of a separate return filed by a married individual) are also included in box 1. “this amount includes the total dependent care benefits that your employer paid to you or incurred on your behalf (including amounts from a section 125 (cafeteria) plan). There are several types of compensation and benefits that can be reported in box 12.

Source: slideshare.net

Source: slideshare.net

The rules state that a married filing separate spouse can only contribute $2500. The irs requires that you supply the amount contributed for the dependent care fsa in box 10. Amounts over $10,500 ($5,250 in the case of a separate return filed by a married individual) are also included in box 1. Arpa increased the maximum amount of dependent care benefits that can be excluded from an employee’s income from $5,000 to $10,500 for most taxpayers. Dependent care benefits include dependent care tax credits, paid leave for the care of dependents, and flexible spending accounts for dependent care.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title dependent care benefits w2 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.