Your Do i need full coverage on a financed car images are available. Do i need full coverage on a financed car are a topic that is being searched for and liked by netizens today. You can Get the Do i need full coverage on a financed car files here. Get all royalty-free photos and vectors.

If you’re searching for do i need full coverage on a financed car pictures information related to the do i need full coverage on a financed car topic, you have come to the ideal blog. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

Do I Need Full Coverage On A Financed Car. However, when you’re done paying offer your vehicle, you can simply have the legal requirement for nashville and hendersonville streets. Do i need full coverage on a financed car? Insurance policies that have full coverage protect both you and your vehicle, as well as other people. Moreover, if you are questioning yourself, ‘do i need full coverage on a financed car?’ an answer to this is yes.

2021 Large Black Gray Camo VINYL Full Car Wrapping From dhgate.com

2021 Large Black Gray Camo VINYL Full Car Wrapping From dhgate.com

Most financial investors or banks require you to have full coverage until the car is paid off. Answer “regardless of the age of the vehicle, most lenders require that you add comprehensive insurance and. With a financed car, you will always need full coverage, which consists of liability, comprehension, and collision coverage. Do i need full coverage on a financed car? Do i need full coverage on a financed car? Most financial investors or banks need you to have full coverage no matter if your vehicle is new or used.

Most financial investors or banks require you to have full coverage until the car is paid off.

Do i need full coverage on a financed car? Until the loan is paid off, the lienholder owns a percentage of your car and requires full. The only time you absolutely need, as in are required, to have full coverage is when you don’t own the vehicle outright. How many years can you finance a used car? If you’re looking to finance a car but find you can’t afford the full coverage auto insurance with the loan payment, perhaps we can help. Whenever you finance a car, the bank or other lender will require that you carry a certain amount of insurance to protect their investment in your car.

Source: thaipoliceplus.com

Source: thaipoliceplus.com

Banks and lenders require minimum coverage for a financed car, usually in the form of a full coverage policy that combines comprehensive, collision, and liability insurance. The lender still, technically, owns any vehicle that still has a balance left on the loan. The simple answer is yes, you need full coverage insurance to finance a car. With a financed car, you will always need full coverage, which consists of liability, comprehension, and collision coverage. Most lienholders typically require you to get full coverage (collision, comprehensive, and liability insurance).

Source: thebalance.com

Source: thebalance.com

Do i need full coverage on a financed car? Yes, you need full coverage on a financed car. Yes, drivers who finance their car are typically required to maintain full coverage car insurance for that vehicle. With a financed car, you will always need full coverage, which consists of liability, comprehension, and collision coverage. Do i need full coverage on a financed car?

Source: accidentlawyerhenderson.com

Source: accidentlawyerhenderson.com

Yes, everyone who finances a vehicle must maintain full coverage auto insurance for the life of their loan. Lenders require clients to maintain full coverage auto insurance to protect their investment. Do i need full coverage on a financed car? However, when you’re done paying offer your vehicle, you can simply have the legal requirement for nashville and hendersonville streets. Most financial investors or banks require you to have full coverage until the car is paid off.

Source: wccftech.com

Source: wccftech.com

Most lenders require you to buy additional auto insurance coverage for your financed or leased vehicle: Full coverage is not required by law, but some insurance companies may require you to buy full coverage auto insurance to finance a car through their company. The lender still, technically, owns any vehicle that still has a balance left on the loan. For example, if you get into a serious accident while still making payments on your vehicle, a complete insurance package will prevent you from catastrophe. However, when you’re done paying offer your vehicle, you can simply have the legal requirement for nashville and hendersonville streets.

Source: autoauctionmall.com

Source: autoauctionmall.com

Full coverage is not required by law, but some insurance companies may require you to buy full coverage auto insurance to finance a car through their company. However, if you are financing a vehicle, lenders want to feel confident that their investments are sound. They want to make sure that their investment is sound, which means full coverage is crucial. If you are still making car payments, then the dealer’s finance company or your. Yes, drivers who finance their car are typically required to maintain full coverage car insurance for that vehicle.

Source: ktmx.pro

Source: ktmx.pro

For as long as the vehicle is being financed, you will likely be required to have full coverage. Insurance policies that have full coverage protect both you and your vehicle, as well as other people. Banks and lenders require minimum coverage for a financed car, usually in the form of a full coverage policy that combines comprehensive, collision, and liability insurance. Until the loan is paid off, the lienholder owns a percentage of your car and requires full. Do i need full coverage on my car?

Do you need full coverage on a financed used car? How many years can you finance a used car? Most lenders require you to buy additional auto insurance coverage for your financed or leased vehicle: If you finance with a bank, you may be required to have full coverage to protect their investment. The lender still, technically, owns any vehicle that still has a balance left on the loan.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The lender still, technically, owns any vehicle that still has a balance left on the loan. Do i need full coverage on a financed car? For more details, read our guide on full coverage and what it costs. Do i need full coverage on my car? However, when you’re done paying offer your vehicle, you can simply have the legal requirement for nashville and hendersonville streets.

Source: treknexus.com

Source: treknexus.com

Do you need full coverage on a financed used car? Do i need full coverage on a financed car? An investor or a bank would need you to have full coverage rather than just liability insurance to protect their investment. Technically, many used car purchases do not require full coverage under law. However, finance lenders want to make sure their investments are sound.

Source: autoauctionmall.com

Source: autoauctionmall.com

For as long as the vehicle is being financed, you will likely be required to have full coverage. Read your contract to understand what minimum coverage you need on your financed car. They want to make sure that their investment is sound, which means full coverage is crucial. But, financiers and lenders almost always require it. If you finance with a bank, you may be required to have full coverage to protect their investment.

Source: autoevolution.com

Source: autoevolution.com

For more details, read our guide on full coverage and what it costs. To drive legally in most states, you�re required by law to have the state�s minimum liability coverage. For example, if you get into a serious accident while still making payments on your vehicle, a complete insurance package will prevent you from catastrophe. Yes, you need full coverage on a financed car. While simple liability insurance is typically cheaper than full coverage, if you have a financed vehicle, full coverage is mandatory.

Read to understand what are the insurance requirements for financed cars, so you’ll know what type of insurance coverage you need, and how it works. Any reputable lender will require drivers with a financed vehicle to purchase comprehensive and collision insurance, in addition to the state’s minimum required car insurance coverage. Do i need full coverage on a financed car? Most lenders will require you to carry full coverage on a financed car. Most states don’t need you to drive with full coverage, no matter if the car is new or used.

Source: bankonus.com

Source: bankonus.com

Answer “regardless of the age of the vehicle, most lenders require that you add comprehensive insurance and. However, if you are financing a vehicle, lenders want to feel confident that their investments are sound. If you finance with a bank, you may be required to have full coverage to protect their investment. You must carry full auto insurance coverage on a financed vehicle. Most lienholders typically require you to get full coverage (collision, comprehensive, and liability insurance).

Source: dhgate.com

Source: dhgate.com

You will also have to keep that full coverage throughout the entire loan period. Most financial investors or banks require you to have full coverage until the car is paid off. Many of our customers wonder “do i need full coverage on a used car?” whether you do you need full coverage on a used financed car is generally down to the lender and how much the car has been financed, and we will cover the basics for minneapolis and maple grove drivers below. The lender still, technically, owns any vehicle that still has a balance left on the loan. Most lenders will require you to carry full coverage on a financed car.

Source: autoauctionmall.com

Source: autoauctionmall.com

For more details, read our guide on full coverage and what it costs. Any reputable lender will require drivers with a financed vehicle to purchase comprehensive and collision insurance, in addition to the state’s minimum required car insurance coverage. Yes, you need full coverage on a financed car. To drive legally in most states, you�re required by law to have the state�s minimum liability coverage. For as long as the vehicle is being financed, you will likely be required to have full coverage.

Source: privateauto.com

Source: privateauto.com

As a refresher, full coverage refers to when you have liability insurance, comprehensive coverage and collision coverage. Buying a new or used vehicle often involves taking out a loan to help finance the purchase. Answer “regardless of the age of the vehicle, most lenders require that you add comprehensive insurance and. However, finance lenders want to ensure their investments are sound. For more details, read our guide on full coverage and what it costs.

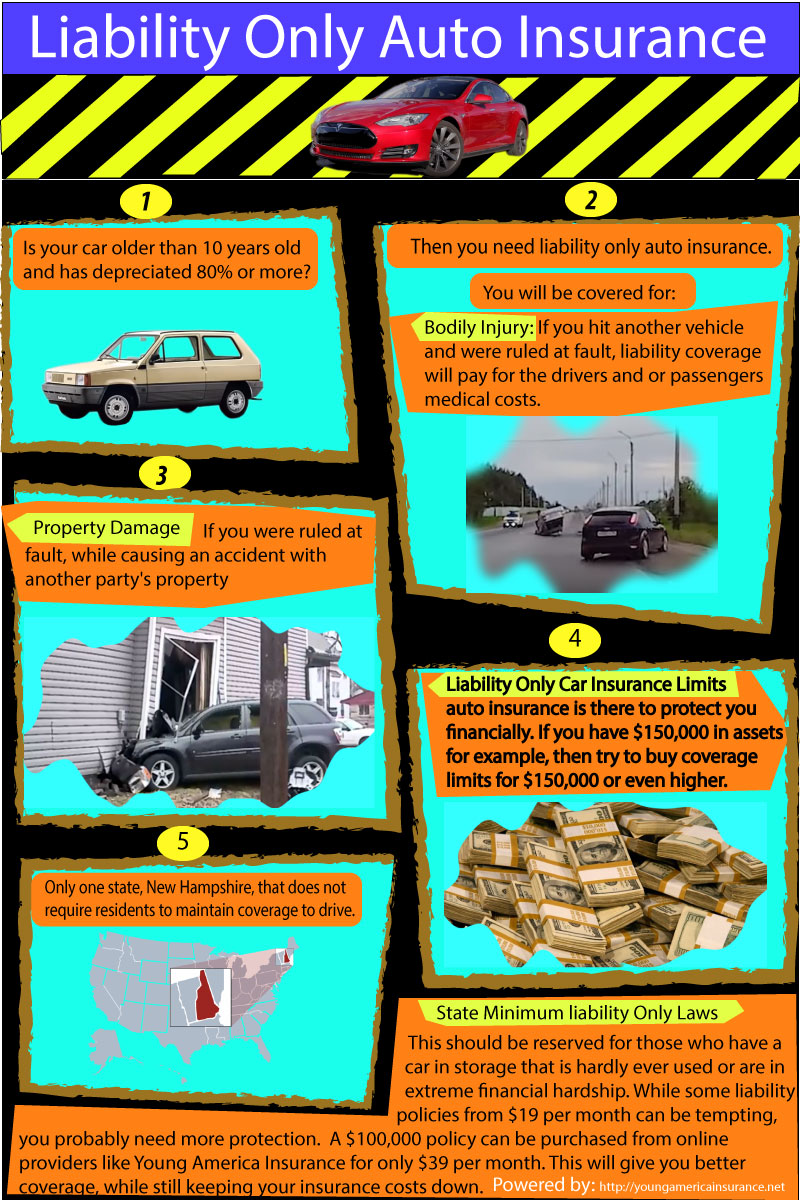

Source: youngamericainsurance.net

Source: youngamericainsurance.net

Read to understand what are the insurance requirements for financed cars, so you’ll know what type of insurance coverage you need, and how it works. Despite the greater cost of full coverage auto insurance, it gives additional coverage. Yes, drivers who finance their car are typically required to maintain full coverage car insurance for that vehicle. Most lenders require you to buy additional auto insurance coverage for your financed or leased vehicle: Moreover, if you are questioning yourself, ‘do i need full coverage on a financed car?’ an answer to this is yes.

Source: dhgate.com

Source: dhgate.com

For more details, read our guide on full coverage and what it costs. Most financial investors or banks need you to have full coverage no matter if your vehicle is new or used. Yes, normally you will need full coverage on a vehicle which you are still paying a lien holder for the loan you have out on it. Whenever you finance a car, the bank or other lender will require that you carry a certain amount of insurance to protect their investment in your car. Until the loan is paid off, the lienholder owns a percentage of your car and requires full.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title do i need full coverage on a financed car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.