Your Does financing a car build credit images are ready. Does financing a car build credit are a topic that is being searched for and liked by netizens now. You can Get the Does financing a car build credit files here. Download all free vectors.

If you’re looking for does financing a car build credit pictures information connected with to the does financing a car build credit interest, you have come to the ideal site. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly search and find more informative video content and images that match your interests.

Does Financing A Car Build Credit. Before you buy or lease a car. Financing a cellphone may help you build credit if the creditor reports your account and payment activity to a credit bureau. Understanding the implications of leasing and preparing your credit will help. Does a car loan build credit?

Should I Get a Car Loan Quote From LendingTree? From thebalance.com

Should I Get a Car Loan Quote From LendingTree? From thebalance.com

For it to build your credit, you need to make your payments on time. Your credit report has information that affects whether you can get a loan — and how much you’ll have to pay in interest to borrow money.; When you apply for a car loan, your application will probably be sent to multiple lenders. If you use a service that does report to the credit bureaus, your payments will affect your credit score. And once you�ve decided on a car, there�s still the question of whether to finance it or lease it. But that doesn’t mean it’s impossible to get a car loan without credit.

If you’re successful at paying back your loans, and keep a low balance on your credit card, these large percentages will have a positive impact on your.

But be careful, because neglecting a car loan is one of the fastest ways to knock your credit score down. Your credit reports show lenders five areas of credit use. The best way to make sure you get the most impact in this area is to pay all your monthly bills. Having no credit shouldn’t prevent you from getting a car loan. As you can see, it’s not a question of whose credit improves, because your car loan will impact both of you. You�ll typically need to make a down payment equivalent to a percentage of the loan amount, then repay the rest of the vehicle�s purchase price over a set time period (the loan term) by making regular monthly.

Source: creditrepairanswers.org

Source: creditrepairanswers.org

It’s not ideal to take out multiple loans at the same time because, each time, your credit score will likely drop. Tips for shopping for an auto loan. However, you can use the car loan to help increase your score. We’ve touched on topics like whether you should buy new or used and the questions you should be asking during the purchasing process. Here is how your fico credit score is calculated:

Source: gobankingrates.com

Source: gobankingrates.com

But you have to keep up on the monthly payments. However, you can use the car loan to help increase your score. Tips for shopping for an auto loan. The good news is financing a car will build credit. It’s important that you read through the fine print to understand how the loan may affect your credit.

Source: deanhonda.com

Source: deanhonda.com

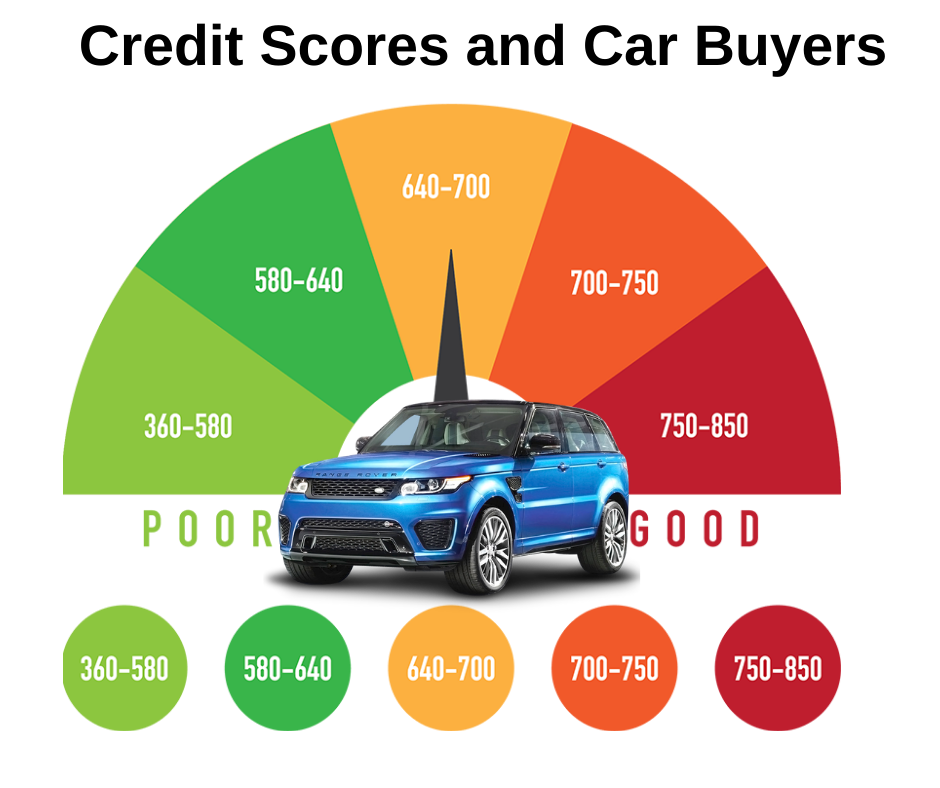

How car loans affect credit. Be careful, because just one late car payment can have a big negative impact much. The longest car loans are for seven years or 84 months. Does a car loan build credit? Your score will increase as it satisfies all of the factors the contribute to a credit score, adding to your payment history, amounts owed, length of credit history, new credit, and credit mix.

Source: thebalance.com

Source: thebalance.com

But that doesn’t mean it’s impossible to get a car loan without credit. If you have no credit or bad credit, your options for financing a car might be limited. However, making a down payment shows a lender you’re willing to take buying and financing a car seriously. Be careful, because just one late car payment can have a big negative impact much. These factors each impact your credit score, some more than others.

Source: thebalance.com

Source: thebalance.com

If you’re ready to make the leap and join the 44% of americans with an auto loan, follow these steps to find the best interest rates: Buying a new vehicle shouldn’t. The main reason a car loan is a good way to build and improve your credit score is because, as you make payments on time, you begin to build a positive payment history. Tips for shopping for an auto loan. Buying a car can help you build a positive credit history if you pay the debt on time and as agreed.

Source: thebalance.com

Source: thebalance.com

Your payment history accounts for 35% of your overall credit score, while 30% of your credit score is based on how much of your revolving credit you’re using. If you are looking to buy a car for the first time, you probably have a lot of questions. If you’re ready to make the leap and join the 44% of americans with an auto loan, follow these steps to find the best interest rates: Does a car loan build credit? However, making a down payment shows a lender you’re willing to take buying and financing a car seriously.

Source: goodsiteslike.com

Source: goodsiteslike.com

As you can see, it’s not a question of whose credit improves, because your car loan will impact both of you. The biggest piece of the pie is payment history, making up 35 percent of your credit score. However, even when that�s not the case, you may need good credit to get approved for a financing offer. When you apply for a car loan, your application will probably be sent to multiple lenders. Buying a car can help you build a positive credit history if you pay the debt on time and as agreed.

Source: pinterest.com

Source: pinterest.com

Many banks and lenders are willing to work with people with limited credit histories. As you can see, it’s not a question of whose credit improves, because your car loan will impact both of you. If you are looking to buy a car for the first time, you probably have a lot of questions. The main reason a car loan is a good way to build and improve your credit score is because, as you make payments on time, you begin to build a positive payment history. That doesn’t mean it’s impossible.

Source: loancheetah.com

Source: loancheetah.com

We’ve touched on topics like whether you should buy new or used and the questions you should be asking during the purchasing process. Your payment history is the biggest factor that makes up your credit score, but it takes time to build. When you take out an auto loan, especially a bad credit car loan, you gain the opportunity to make a positive impact on your credit by making all your monthly payments on time and in full. A first car loan, even if it’s from a subprime lender, can help build a good credit score if. You�ll also still have to follow through with your payments, as a phone account in collections can still wind up hurting your credit.

Source: pinterest.com

Source: pinterest.com

You�ll typically need to make a down payment equivalent to a percentage of the loan amount, then repay the rest of the vehicle�s purchase price over a set time period (the loan term) by making regular monthly. Your payment history accounts for 35% of your overall credit score, while 30% of your credit score is based on how much of your revolving credit you’re using. The longest car loans are for seven years or 84 months. It’s generally a good idea to take some time to build your credit before applying for car financing — if you’re able to wait. If you have no credit or bad credit, your options for financing a car might be limited.

Source: buildpriceoption.com

Source: buildpriceoption.com

You can get an auto loan without money down if a lender approves you. But that doesn’t mean it’s impossible to get a car loan without credit. Thereof does financing a car help your credit score? By doing this, you can improve not only your credit, but your cosigner’s, as well. Buying a car with no credit.

Source: access-insurance.com

Source: access-insurance.com

When you finance a car, a financial institution lends you the money you need to pay for the vehicle in the form of installment credit. And once you�ve decided on a car, there�s still the question of whether to finance it or lease it. The best way to make sure you get the most impact in this area is to pay all your monthly bills. How long will they finance a used car? If you�re concerned about how this decision will factor into your credit report and scores, rest assured—their impact is the same.

Source: pinterest.com

Source: pinterest.com

Your payment history accounts for 35% of your overall credit score, while 30% of your credit score is based on how much of your revolving credit you’re using. Financing a car can be an excellent tool for building credit. Does a car loan build credit? It�s really up to you. We’ve touched on topics like whether you should buy new or used and the questions you should be asking during the purchasing process.

Source: creditwalls.blogspot.com

Source: creditwalls.blogspot.com

But you have to keep up on the monthly payments. When you apply for a car loan, your application will probably be sent to multiple lenders. When you take out an auto loan, especially a bad credit car loan, you gain the opportunity to make a positive impact on your credit by making all your monthly payments on time and in full. How long will they finance a used car? But that doesn’t mean it’s impossible to get a car loan without credit.

Source: aliettes.blogspot.com

Source: aliettes.blogspot.com

Buying a new vehicle shouldn’t. Be careful, because just one late car payment can have a big negative impact much. It can be seen as an opportunity to start building your credit so you can qualify for better loans later. When you finance a car, a financial institution lends you the money you need to pay for the vehicle in the form of installment credit. Having a loan itself doesn’t help build your credit.

Source: pinterest.com

Source: pinterest.com

You can get an auto loan without money down if a lender approves you. The good news is financing a car will build credit. Having no credit shouldn’t prevent you from getting a car loan. However, even when that�s not the case, you may need good credit to get approved for a financing offer. It adds a hard inquiry to your credit report, which might temporarily shave a few points off your score.

Source: youtube.com

Source: youtube.com

Your credit reports show lenders five areas of credit use. If you use a service that does report to the credit bureaus, your payments will affect your credit score. The best way to make sure you get the most impact in this area is to pay all your monthly bills. Buying a car with no credit. Does a car loan build credit?

Source: pinterest.com

Source: pinterest.com

As you can see, it’s not a question of whose credit improves, because your car loan will impact both of you. Your score will increase as it satisfies all of the factors the contribute to a credit score, adding to your payment history, amounts owed, length of credit history, new credit, and credit mix. In fact, the loan will lower your credit score initially because you’ve taken on extra debt. Here is how your fico credit score is calculated: The biggest reason why involves your payment history, which makes up 35 percent of your fico credit score and is the most important factor.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does financing a car build credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.