Your Does paying car insurance build credit images are available. Does paying car insurance build credit are a topic that is being searched for and liked by netizens today. You can Download the Does paying car insurance build credit files here. Download all royalty-free images.

If you’re searching for does paying car insurance build credit images information connected with to the does paying car insurance build credit interest, you have come to the right blog. Our website always provides you with hints for refferencing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Does Paying Car Insurance Build Credit. Paying monthly is also usually more expensive than paying for your car insurance in one go, as providers typically charge interest on the monthly instalments. Remember, you won’t build credit just by making your car insurance payments. Just make sure you pay in full each. But this simply means the total cost is split equally over the 12 months of the policy term.

What You Must Know About the Social Security Debit Card From thebalance.com

What You Must Know About the Social Security Debit Card From thebalance.com

Does car insurance appear on your credit report? There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt collection reports. But when it comes to car insurance, paying your premiums has little to do with improving your credit score. Even if you pay on time faithfully every month like clockwork. But this simply means the total cost is split equally over the 12 months of the policy term. Does a car loan build credit?

In fact, experian mentions that once you take on a car loan, your.

Online through your insurer’s website over the phone through a mobile app (depending on your insurance company) The primary cardholder is ultimately responsible for payments. It actually does the opposite. If you are late or miss a payment, this will bring down your credit rating. Now your auto insurance payment is working for you by establishing a payment history on that credit card account, improving your credit score. Whether it is your car insurance or life insurance, paying their premiums on time won’t count in your credit score.

Source: emailkaydol.co

Source: emailkaydol.co

Continually maxing out your credit card or purchasing near its limit can have a negative impact on your credit score. Even if you pay on time faithfully every month like clockwork. And that�s no different for car insurance. But using a credit card to pay those insurance premiums can have an indirect impact. If you are late or miss a payment, this will bring down your credit rating.

Source: suupesrsdsasawqw223.blogspot.com

Paying certain bills on time can help you build credit. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt collection reports. Simply paying most of your normal monthly bills each month like your car insurance, utilities, and health insurance will not help you actually build your credit rating. Most major car insurance companies will give you the option of paying your car insurance premium with a credit card, and many give you the choice of making your payments through various channels: Continually maxing out your credit card or purchasing near its limit can have a negative impact on your credit score.

Source: thebalance.com

Source: thebalance.com

Why it�s important to build credit. Exactly and the fact that you have paid every insurance payment on time is not credited anywhere m.p 4400 • 3 years ago it is unfair practice for one credit report to be use to get car insurance so one can be over charge for insurance If you pay in full and on time every month, this can build up your credit score over time. The primary cardholder is ultimately responsible for payments. You aren’t exercising a kind of credit or loan, so there is no reason to report the payments to credit bureaus.

Source: ineedhelppayingbills.com

Source: ineedhelppayingbills.com

But if you have a poor credit history, you may pay more for a monthly premium. But this simply means the total cost is split equally over the 12 months of the policy term. Your insurer could also cancel your policy. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt collection reports. As an authorized user of someone else’s credit card, you could benefit from their credit history—if it’s good—and continued responsible use.

Source: launchmyscores.com

Source: launchmyscores.com

Whether it is your car insurance or life insurance, paying their premiums on time won’t count in your credit score. Some providers market their pay monthly car insurance policies as “no deposit car insurance”. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt collection reports. Exactly and the fact that you have paid every insurance payment on time is not credited anywhere m.p 4400 • 3 years ago it is unfair practice for one credit report to be use to get car insurance so one can be over charge for insurance Because car insurance companies are not lending you money, they don�t report your payments to.

Source: self.inc

Source: self.inc

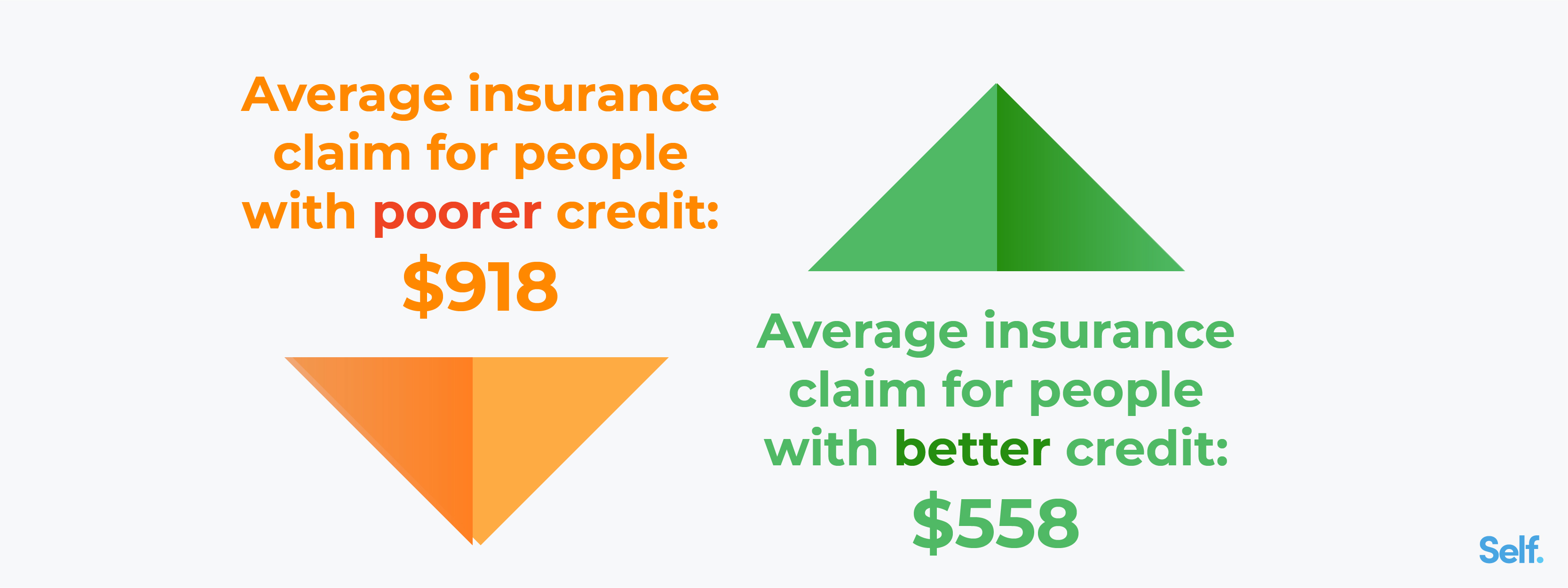

That’s because, statistically, people with low credit ratings are more likely to make car insurance claims. Car dealers, lenders, and auto manufacturers aren’t required to report payments to the three major credit bureaus, but most report payments every month to equifax, experian, and transunion. Paying certain bills on time can help you build credit. Because car insurance companies are not lending you money, they don�t report your payments to. For example, if paying off a car loan bumps your average account age from four to.

Source: launchmyscores.com

Source: launchmyscores.com

There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt collection reports. Notify your car insurance company when you’ve paid off your loan so you can remove the lien holder from your policy. Just make sure you pay in full each. However, paying your insurance on time does help you avoid late fees and get into good habits that could later translate to helping you build credit. Does paying for car insurance monthly build credit score?

Source: launchmyscores.com

Source: launchmyscores.com

However, late or no payments will be. Paying monthly is also usually more expensive than paying for your car insurance in one go, as providers typically charge interest on the monthly instalments. The short answer is no. This is known as having a thin credit file, which typically consists of four or fewer accounts. Whether it is your car insurance or life insurance, paying their premiums on time won’t count in your credit score.

Source: emailkaydol.co

Source: emailkaydol.co

If you are late or miss a payment, this will bring down your credit rating. But using a credit card to pay those insurance premiums can have an indirect impact. You will still have to make the first, albeit potentially smaller, payment to get insurance. When you pay monthly, your insurer will carry out what�s called a hard check on your credit file. Paying certain bills on time can help you build credit.

Source: thebalance.com

Source: thebalance.com

It�s hardly a unique situation. And that�s no different for car insurance. And as long as you pay the minimum amount required by your card issuer, the exact amount you. But if you have a poor credit history, you may pay more for a monthly premium. Paying monthly is also usually more expensive than paying for your car insurance in one go, as providers typically charge interest on the monthly instalments.

Source: thebalance.com

Source: thebalance.com

This step is important because if your financed vehicle were totaled in a wreck, the insurance payment would go to the lender. Does a car loan build credit? Simply paying most of your normal monthly bills each month like your car insurance, utilities, and health insurance will not help you actually build your credit rating. Every time you make at least the minimum credit card payment by the due date, positive information is reported to credit bureaus. Does paying for car insurance monthly build credit score?

Source: self.inc

Source: self.inc

Does a car loan build credit? You don’t need to wait until you have the title in your hand to make the call. Paying certain bills on time can help you build credit. However, late or no payments will be. Your insurer could also cancel your policy.

Source: emailkaydol.co

Source: emailkaydol.co

For example, if paying off a car loan bumps your average account age from four to. How paying monthly for car insurance affects your credit score whenever you take out credit, you�ll have to go through a credit check. If you put your car insurance premium on your credit card and can�t pay it off, you�ll increase your debt. A car loan in and of itself does not build credit. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt collection reports.

Source: thebalance.com

Source: thebalance.com

Most major car insurance companies will give you the option of paying your car insurance premium with a credit card, and many give you the choice of making your payments through various channels: One way to work around not having your auto insurance reported to your account is to charge it to a credit account. If you put your car insurance premium on your credit card and can�t pay it off, you�ll increase your debt. By kara mcginley & andrew hurst updated february 7, 2022 | 3 min read Paying monthly is also usually more expensive than paying for your car insurance in one go, as providers typically charge interest on the monthly instalments.

Source: thebalance.com

Source: thebalance.com

Why it�s important to build credit. However, if you stop paying these same bills on time or even fall behind on those payments, it can damage your. By kara mcginley & andrew hurst updated february 7, 2022 | 3 min read You aren’t exercising a kind of credit or loan, so there is no reason to report the payments to credit bureaus. Car dealers, lenders, and auto manufacturers aren’t required to report payments to the three major credit bureaus, but most report payments every month to equifax, experian, and transunion.

Source: forbes.com

Source: forbes.com

One way to work around not having your auto insurance reported to your account is to charge it to a credit account. The short answer is no. However, if you fail to pay your car insurance bill long enough, that bill could be turned over to a collections agency and listed as a “delinquent” payment to the credit bureaus, hurting. Simply paying most of your normal monthly bills each month like your car insurance, utilities, and health insurance will not help you actually build your credit rating. But this simply means the total cost is split equally over the 12 months of the policy term.

Source: capitalone.com

Source: capitalone.com

Car dealers, lenders, and auto manufacturers aren’t required to report payments to the three major credit bureaus, but most report payments every month to equifax, experian, and transunion. Many people expect that their credit score will increase after paying off a car loan. Paying certain bills on time can help you build credit. This step is important because if your financed vehicle were totaled in a wreck, the insurance payment would go to the lender. Does a car loan build credit?

Source: stingypig.ca

Source: stingypig.ca

Now your auto insurance payment is working for you by establishing a payment history on that credit card account, improving your credit score. Why it�s important to build credit. Does car insurance appear on your credit report? But using a credit card to pay those insurance premiums can have an indirect impact. But when it comes to car insurance, paying your premiums has little to do with improving your credit score.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does paying car insurance build credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.