Your How many car payments can you missed before repo images are available. How many car payments can you missed before repo are a topic that is being searched for and liked by netizens now. You can Download the How many car payments can you missed before repo files here. Download all royalty-free vectors.

If you’re looking for how many car payments can you missed before repo pictures information linked to the how many car payments can you missed before repo keyword, you have visit the right blog. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

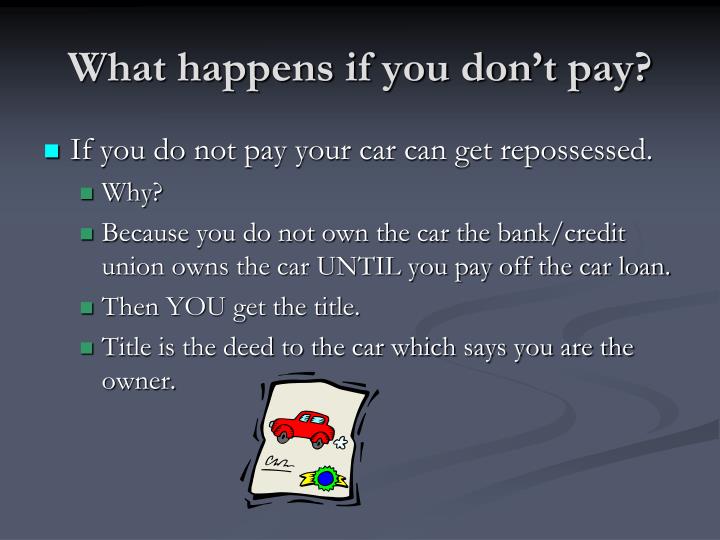

How Many Car Payments Can You Missed Before Repo. Waiting for the repo man Technically, in many states, a lender can begin the repossession process if you are just one day late with your payment. After five business days of handing in the letter, you must return the vehicle or arrange with your creditor how the car will be returned. All told, the incident could stay on your credit report for seven years.

How many car payments can you miss before repossession From quoteyeti.com

How many car payments can you miss before repossession From quoteyeti.com

Typically, you can miss three payments before default. Before the lender seizes your vehicle, it�ll report your initial late payments that can lead to a default and repossession. But if you�ve been late before, your number may come up right away. While laws on repossession vary from state to state, most can be harsh if you haven�t made your car payments. The notice can only be sent 10 days after nonpayment the notice must have this title: If you miss a car payment, your lender will likely charge a late fee after a grace period has passed.

If you miss a car payment, your lender will likely charge a late fee after a grace period has passed.

You will then have to pay the difference between. All told, the incident could stay on your credit report for seven years. One missed payment can result in repossession, but it’s less common. And know that if you contact the lender. The repossession business went into a slumber of sorts during the 2020 shutdown, but in 2021 repo men and women are making up for lost time. About a decade ago, when erin hayes was in her late teens, she bought a used car with a subprime loan from one of those “buy here, pay here” car lots close to her home near raleigh.

Source: usatoday.com

Source: usatoday.com

But even if you return the car voluntarily, you’re still responsible for paying any deficiency on your contract, and your creditor still may put the late payments or repossession on your credit report. About a decade ago, when erin hayes was in her late teens, she bought a used car with a subprime loan from one of those “buy here, pay here” car lots close to her home near raleigh. If you’re behind on your car payments and your creditor is threatening to repossess your car, here are some helpful suggestions. If you still owe money on the car after it is taken, and you don�t pay, the lender may secure a judgment against you in court. A repossession is a sign that you didn�t pay your debt as originally agreed, and once the lender reports that you defaulted, it can hurt your score even more than the late payments.

Source: venturebeat.com

Source: venturebeat.com

Laws on repossession vary by state, so it’s difficult to say how long you’ll have after missing a payment, although payments just one day late can often put you on the fast track to losing your car. The repossession business went into a slumber of sorts during the 2020 shutdown, but in 2021 repo men and women are making up for lost time. Each state has its own repossession laws, which may affect how many payments you can miss before car. This is called the “default cure” period. Contact your creditor when you realize that you will be late with a payment.

Source: smallbusiness.yahoo.com

Source: smallbusiness.yahoo.com

The maximum number of missed payments before repossession depends on the leniency of your lender. Owners will receive no warning when the car goes into repo status. If you’re behind on your car payments and your creditor is threatening to repossess your car, here are some helpful suggestions. For example, if your monthly amortization is p10,000 then the late payment fee will be p500. Just one missed car payment puts you at risk of repossession, depending on the language of your loan contract.

Source: rememeberlessfool.blogspot.com

Source: rememeberlessfool.blogspot.com

The repossession business went into a slumber of sorts during the 2020 shutdown, but in 2021 repo men and women are making up for lost time. But even if you return the car voluntarily, you’re still responsible for paying any deficiency on your contract, and your creditor still may put the late payments or repossession on your credit report. Every state has its repossession laws, but generally, your bank or lender will begin the repossession process after three or more missed payments. Contact your creditor when you realize that you will be late with a payment. In some states, the loan company can seize a car as soon as a payment is missed according to the federal trade commission.

Source: edmunds.com

Source: edmunds.com

All told, the incident could stay on your credit report for seven years. If you can’t reach an agreement, your lender may demand that you return the car. The notice can only be sent 10 days after nonpayment the notice must have this title: For example, if your loan balance is $10,000, and you have missed a monthly payment of $500, your lender can demand that you pay the $10,000 all at once. Each state has its own repossession laws, which may affect how many payments you can miss before car.

Source: especials.co.za

Source: especials.co.za

In some states, the loan company can seize a car as soon as a payment is missed according to the federal trade commission. The number of car payments that can be missed depends on the purchaser’s credit history and the loan company’s policy on repossession. After five business days of handing in the letter, you must return the vehicle or arrange with your creditor how the car will be returned. For example, if your monthly amortization is p10,000 then the late payment fee will be p500. All told, the incident could stay on your credit report for seven years.

Source: theusedcarguy.co.uk

Source: theusedcarguy.co.uk

“if you miss two payments, you should start getting a little bit concerned, and if you miss three payments and your car is still sitting in your driveway, you may not have much more time.” For example, if your monthly amortization is p10,000 then the late payment fee will be p500. But each lender is different, as are the repossession laws in each state. If you�ve never missed a payment, you might not be subject to repossession immediately. But even if you return the car voluntarily, you’re still responsible for paying any deficiency on your contract, and your creditor still may put the late payments or repossession on your credit report.

Source: yayofamilia.uk

Source: yayofamilia.uk

“the efforts to repossess your car typically start after you’ve missed a couple of consecutive payments,” he said. If you�ve never missed a payment, you might not be subject to repossession immediately. For more on how to deal. The notice can only be sent 10 days after nonpayment the notice must have this title: If you’ve missed a payment on your car loan, don’t panic — but do act fast.

Source: blog.moonlighting.com

Source: blog.moonlighting.com

The notice can only be sent 10 days after nonpayment the notice must have this title: Just one missed car payment puts you at risk of repossession, depending on the language of your loan contract. “if you miss two payments, you should start getting a little bit concerned, and if you miss three payments and your car is still sitting in your driveway, you may not have much more time.” But once you�ve missed multiple payments, you risk your loan going into default. Waiting for the repo man

Source: yoninetanyahu.com

Source: yoninetanyahu.com

The number of car payments that can be missed depends on the purchaser’s credit history and the loan company’s policy on repossession. Laws on repossession vary by state, so it’s difficult to say how long you’ll have after missing a payment, although payments just one day late can often put you on the fast track to losing your car. For more on how to deal. Under normal circumstances, most lenders will report a late payment to the credit bureaus once it�s at least 30 days overdue, and they�ll typically come to. Technically, in many states, a lender can begin the repossession process if you are just one day late with your payment.

Source: talias.org

Source: talias.org

There’s no set amount of time that dictates when repossession can take place. About a decade ago, when erin hayes was in her late teens, she bought a used car with a subprime loan from one of those “buy here, pay here” car lots close to her home near raleigh. “the efforts to repossess your car typically start after you’ve missed a couple of consecutive payments,” he said. Typically, you can miss three payments before default. Waiting for the repo man

Source: quoteyeti.com

Source: quoteyeti.com

The maximum number of missed payments before repossession depends on the leniency of your lender. How many car payments can you miss before repossession? Under normal circumstances, most lenders will report a late payment to the credit bureaus once it�s at least 30 days overdue, and they�ll typically come to. According to some state laws, you may be able to miss two or three payments before a repo occurs. Two or three consecutive missed payments can lead to repossession, which damages your credit score.

Source: newslinkpathway.blogspot.com

It�s considered a missed payment if you go past 30 days before making a payment. If you still owe money on the car after it is taken, and you don�t pay, the lender may secure a judgment against you in court. But even if you return the car voluntarily, you’re still responsible for paying any deficiency on your contract, and your creditor still may put the late payments or repossession on your credit report. Technically, in many states, a lender can begin the repossession process if you are just one day late with your payment. According to some state laws, you may be able to miss two or three payments before a repo occurs.

Source: myfrugalhome.com

Source: myfrugalhome.com

But each lender is different, as are the repossession laws in each state. There’s usually a maximum of 3 months grace period though it still depends on the actual contract you signed. I have a 2007 didge ram i financed with genisys credit union, three years ago, lost job, took on one with pay cut, now i cannot make the $462.00 monthly payments, they will not extend loan nor reduce payments, missed two payments and am i missing something, this was in michigan, live in tennessee now, each day i come home from work expecting my truck to be. One missed payment can result in repossession, but it’s less common. When you’re struggling financially, trying to figure which creditors to pay can make you feel like you’re walking a tightrope.

Source: slideserve.com

Source: slideserve.com

How many car payments can you miss before repossession? If you still owe money on the car after it is taken, and you don�t pay, the lender may secure a judgment against you in court. A repossession is a sign that you didn�t pay your debt as originally agreed, and once the lender reports that you defaulted, it can hurt your score even more than the late payments. How does the repo process work? Contact your creditor when you realize that you will be late with a payment.

Source: secretentourage.com

Source: secretentourage.com

If you�ve never missed a payment, you might not be subject to repossession immediately. In some states, the loan company can seize a car as soon as a payment is missed according to the federal trade commission. If you have missed several payments on your vehicle, the lender can repossess your car and sell it at an auction. Many “buy here, pay here” car dealers use starter interrupt devices called “kill switches” that will turn off the car if the owner misses a payment. If that happens, your lender may repossess your vehicle.

Source: nairaland.com

The repossession business went into a slumber of sorts during the 2020 shutdown, but in 2021 repo men and women are making up for lost time. About a decade ago, when erin hayes was in her late teens, she bought a used car with a subprime loan from one of those “buy here, pay here” car lots close to her home near raleigh. This clause allows the lender to demand the full amount of the outstanding loan if you miss a payment. Reveal number private message posted on nov 5, 2011 in general, when you miss a payment, you are in default under the title loan and the lender can immediately repossess the vehicle. If you agree to a “voluntary repossession,” you might pay less in fees.

Source: simplystacie.net

Source: simplystacie.net

If you still owe money on the car after it is taken, and you don�t pay, the lender may secure a judgment against you in court. Waiting for the repo man If you do not, it can repossess the car. If you agree to a “voluntary repossession,” you might pay less in fees. For example, if your monthly amortization is p10,000 then the late payment fee will be p500.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how many car payments can you missed before repo by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.