Your Illinois car tax images are ready in this website. Illinois car tax are a topic that is being searched for and liked by netizens now. You can Find and Download the Illinois car tax files here. Download all royalty-free images.

If you’re searching for illinois car tax images information linked to the illinois car tax topic, you have pay a visit to the ideal blog. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Illinois Car Tax. What is the sales tax on a car in illinois? Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction. Trips or mileage of a motor vehicle, trailer, limousine, aircraft, watercraft, or rail carrier item in or on which persons or property are carried for hire just between points in illinois may be used to qualify for the exemption if the journey of the passenger or shipment of the property either originates or terminates outside illinois. For most purchases, you will use table a or b to determine the tax amount.

Illinois Used Car Sales Tax Dealer / Used Cars For Sale In From gojipower4u.blogspot.com

Illinois Used Car Sales Tax Dealer / Used Cars For Sale In From gojipower4u.blogspot.com

Private party vehicle use tax sales taxes. And if it was $30,000 or more, then the tax was $1,500. Purchasing out of state if a vehicle is purchased out of state, the following items must be sent to the secretary of state’s office to obtain a certificate of title and license plates: Illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. Whether you’re buying a new or used vehicle; 7.75% for vehicle over $50,000.

If the vehicle purchase price is $15,000 or more, the tax is based on the purchase price.

The trade off to eliminate the tax cap was to slightly increase. Can be used as content for research and analysis. The trade off to eliminate the tax cap was to slightly increase. For motor vehicle tax questions, please contact: This new provision, part of senate bill 58 that was supported by both the chicago automobile trade association (cata) and illinois automotive dealers association, reverses the $10,000 cap that was set in 2020 as part of gov. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate.

Source: abc7chicago.com

Source: abc7chicago.com

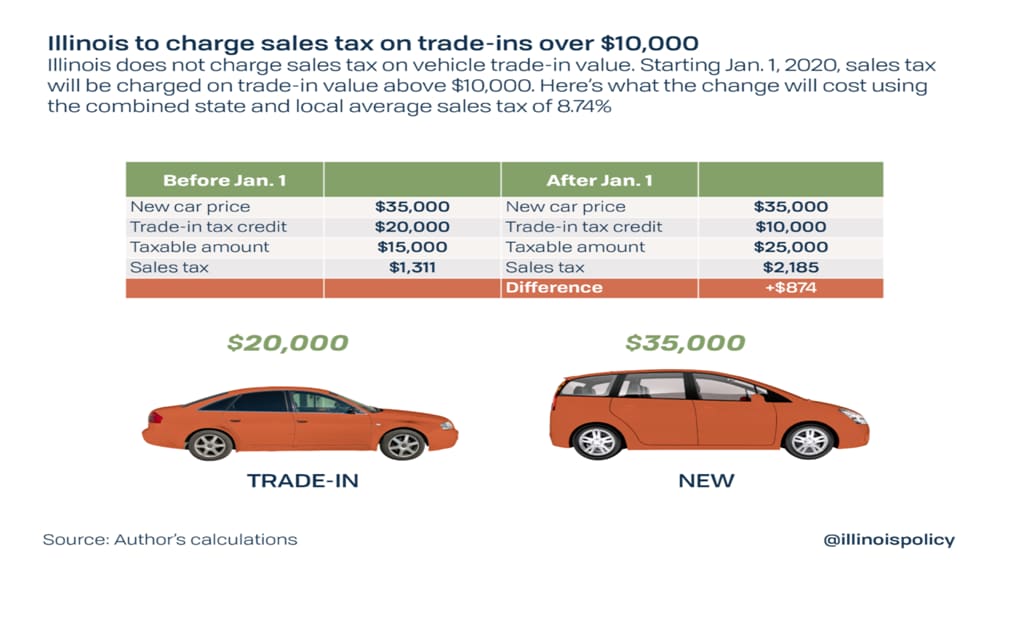

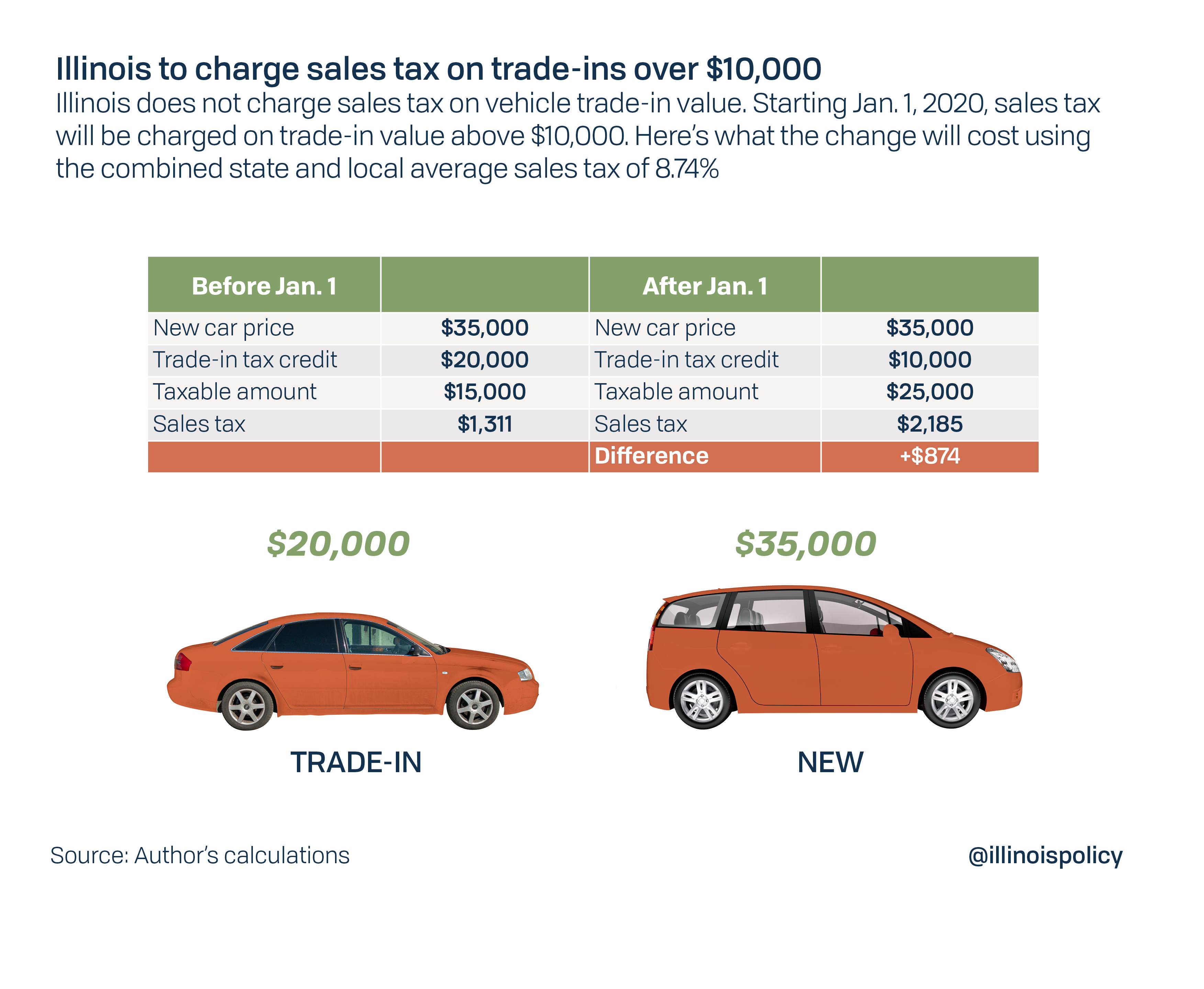

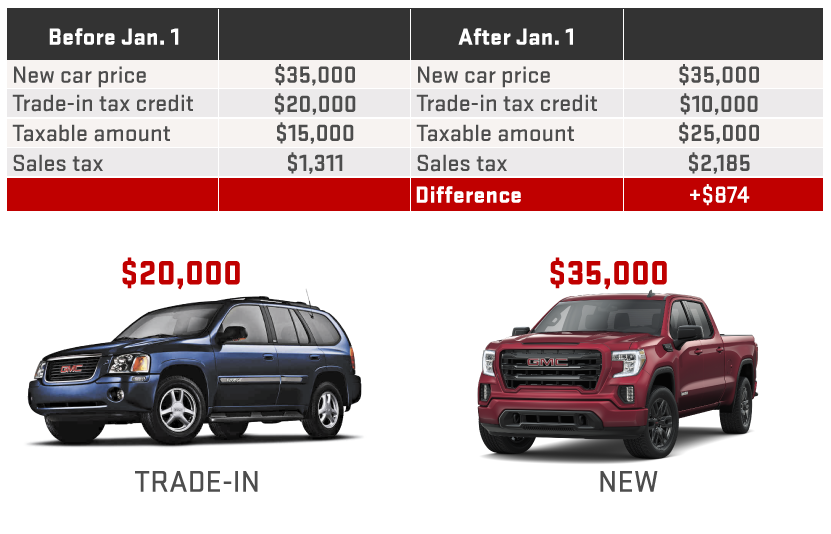

For motor vehicle tax questions, please contact: In addition to state and county tax, the city of chicago has a 1.25% sales tax. The trade off to eliminate the tax cap was to slightly increase. Dealers call it double taxation. Trading in your car in illinois has just become a little more expensive.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

The vehicle registration fee is $150. For vehicles worth less than 15 000 the tax is based on the age of the vehicle. Trips or mileage of a motor vehicle, trailer, limousine, aircraft, watercraft, or rail carrier item in or on which persons or property are carried for hire just between points in illinois may be used to qualify for the exemption if the journey of the passenger or shipment of the property either originates or terminates outside illinois. Purchasing out of state if a vehicle is purchased out of state, the following items must be sent to the secretary of state’s office to obtain a certificate of title and license plates: The rev act establishes the reimagining electric vehicles in illinois program (the rev program) to provide certain tax incentives to eligible manufacturers of electric vehicles, electric vehicle.

Source: gojipower4u.blogspot.com

Source: gojipower4u.blogspot.com

Selling a vehicle in illinois. For motor vehicle tax questions, please contact: Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. Illinois sales tax on cars. The purchase price of a vehicle is the value given whether received in money

Source: carsalerental.com

Taxes must be made payable to illinois department of revenue, but submitted along with all other documents and fees to the secretary of state. Illinois sales tax on car purchases according to the sales tax handbook, because vehicle purchases are prominent in illinois, they may. Illinois tax on new and used vehicles is generally 6.25% but can vary by location. 6.35% for vehicle $50k or less. What is the sales tax on a car in illinois?

Source: dtaxc.blogspot.com

Source: dtaxc.blogspot.com

Purchasing out of state if a vehicle is purchased out of state, the following items must be sent to the secretary of state’s office to obtain a certificate of title and license plates: Taxes must be made payable to illinois department of revenue, but submitted along with all other documents and fees to the secretary of state. The rev act establishes the reimagining electric vehicles in illinois program (the rev program) to provide certain tax incentives to eligible manufacturers of electric vehicles, electric vehicle. Illinois used car taxes and fees. The vehicle registration fee is $150.

Source: subaruchicago.com

Source: subaruchicago.com

4.25% motor vehicle document fee. 6.35% for vehicle $50k or less. Illinois sales tax on car purchases according to the sales tax handbook, because vehicle purchases are prominent in illinois, they may. If the market value was less than $15,000, then the tax is based on the age of the car, ranging from $390 for a new car to $25 for a car 11 years or older. This new provision, part of senate bill 58 that was supported by both the chicago automobile trade association (cata) and illinois automotive dealers association, reverses the $10,000 cap that was set in 2020 as part of gov.

Source: gojipower4u.blogspot.com

Source: gojipower4u.blogspot.com

There is also between a 0.25% and 0.75% when it comes to county tax. And if it was $30,000 or more, then the tax was $1,500. Their vehicle tax is higher, so you’d owe 2.275% (.02275) of your purchase price. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. For motor vehicle tax questions, please contact:

Source: subaruchicago.com

Source: subaruchicago.com

Illinois tax on new and used vehicles is generally 6.25% but can vary by location. Trading in your car in illinois has just become a little more expensive. 6.35% for vehicle $50k or less. The purchase price of a vehicle is the value given whether received in money The rev act establishes the reimagining electric vehicles in illinois program (the rev program) to provide certain tax incentives to eligible manufacturers of electric vehicles, electric vehicle.

Source: dtaxc.blogspot.com

Source: dtaxc.blogspot.com

Collected from the entire web and summarized to include only the most important parts of it. If the vehicle purchase price is $15,000 or more, the tax is based on the purchase price. Purchasing out of state if a vehicle is purchased out of state, the following items must be sent to the secretary of state’s office to obtain a certificate of title and license plates: Illinois has a 6.25% statewide sales tax rate, but also has 495 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.904% on top of the state tax. Private party vehicle use tax sales taxes.

Source: illinoispolicy.org

Source: illinoispolicy.org

Trips or mileage of a motor vehicle, trailer, limousine, aircraft, watercraft, or rail carrier item in or on which persons or property are carried for hire just between points in illinois may be used to qualify for the exemption if the journey of the passenger or shipment of the property either originates or terminates outside illinois. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. If the vehicle purchase price is $15,000 or more, the tax is based on the purchase price. For vehicles worth less than 15 000 the tax is based on the age of the vehicle. That’s $455 on a $20,000 car.

Source: thecentersquare.com

Source: thecentersquare.com

Trading in your car in illinois has just become a little more expensive. And if it was $30,000 or more, then the tax was $1,500. Whether you’re buying a new or used vehicle; Illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. If it was between $25,000 and $29,999.99, then the tax was $1,250.

Source: illinoispolicy.org

Source: illinoispolicy.org

Thanks to a new law effective jan. This new provision, part of senate bill 58 that was supported by both the chicago automobile trade association (cata) and illinois automotive dealers association, reverses the $10,000 cap that was set in 2020 as part of gov. The vehicle registration fee is $150. Illinois tax on new and used vehicles is generally 6.25% but can vary by location. For motor vehicle tax questions, please contact:

Source: carsalerental.com

Source: carsalerental.com

For most purchases, you will use table a or b to determine the tax amount. If the market value was less than $15,000, then the tax is based on the age of the car, ranging from $390 for a new car to $25 for a car 11 years or older. Illinois sales tax on cars. With the new tax law, countryside drivers will be paying. Whether you’re buying a new or used vehicle;

Source: saleofcar.com

Source: saleofcar.com

If you purchased the vehicle in another state you should pay the sales tax in that state and bring proof of. This new provision, part of senate bill 58 that was supported by both the chicago automobile trade association (cata) and illinois automotive dealers association, reverses the $10,000 cap that was set in 2020 as part of gov. This means that, depending on your location within illinois, the total tax you pay can be significantly higher than the 6.25% state sales tax. 6.35% for vehicle $50k or less. The amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you live in.

Source: illinoispolicy.org

Source: illinoispolicy.org

If the market value was less than $15,000, then the tax is based on the age of the car, ranging from $390 for a new car to $25 for a car 11 years or older. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. 7.75% for vehicle over $50,000. Illinois has a 6.25% statewide sales tax rate, but also has 495 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.904% on top of the state tax. Illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the right (i.e., for motorcycles and specific situations).

Source: vwofchicagoland.com

Source: vwofchicagoland.com

Thanks to a new law effective jan. Illinois used car taxes and fees. Illinois has a 6.25% statewide sales tax rate, but also has 495 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.904% on top of the state tax. For motor vehicle tax questions, please contact: Collected from the entire web and summarized to include only the most important parts of it.

Source: dtaxc.blogspot.com

Source: dtaxc.blogspot.com

A license renewal sticker starts at $101. The vehicle registration fee is $150. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. Illinois sales tax on cars. Selling a vehicle in illinois.

Source: weddinghazel.blogspot.com

Source: weddinghazel.blogspot.com

If it was between $20,000 and $24,999.99, then the tax was $1,000. Whether you’re buying a new or used vehicle; The purchase price of a vehicle is the value given whether received in money Collected from the entire web and summarized to include only the most important parts of it. The vehicle registration fee is $150.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title illinois car tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.