Your Illinois electric car tax credit images are available. Illinois electric car tax credit are a topic that is being searched for and liked by netizens today. You can Find and Download the Illinois electric car tax credit files here. Find and Download all free photos.

If you’re looking for illinois electric car tax credit pictures information related to the illinois electric car tax credit keyword, you have pay a visit to the ideal blog. Our site always provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

Illinois Electric Car Tax Credit. Jb pritzker signed into law a tax incentives package tuesday that state lawmakers hope will help illinois become a manufacturing hub for the budding electric vehicle industry. The federal ev tax credit may go up to $12,500 ev tax credit for new electric vehicles. Illinois offers tax credits to electric car, battery makers. Illinois will offer significant benefits to electric vehicle and battery manufacturers locating in the state under tax incentive legislation approved tuesday by.

I bought a gas guzzler with the government’s EV tax credit From flipboard.com

I bought a gas guzzler with the government’s EV tax credit From flipboard.com

It turns out the bill also hikes the registration fee to $148 for all vehicles, but to $248 for evs specifically. Among states, incentives for electric cars vary wildly—from colorado, which offers a $5,000 tax credit for ev buyers, to illinois, where the legislature just proposed a $1,000 annual registration fee for electric cars. Jb pritzker signed illinois’ clean energy law on wednesday, which includes a $4,000 rebate for residents to buy an electric vehicle (ev). Federal electric vehicle (ev) tax credits for a few of the country’s largest auto manufacturers, one u.s. Replacing coal and natural gas with renewable energy is just the beginning of what’s in a massive bill passed by illinois lawmakers. Federal and state electric car tax credits, incentives & rebates.

Electric vehicle federal tax credit up to $7,500 a federal income tax credit up to $7,500 is available for the purchase of a qualifying ev.

Following the release of updated u.s. The minimum credit amount is $2,500, and the credit may be up to $7,500, based on each vehicle�s. Currently, the federal government offers a $7,500 tax credit when purchasing qualifying electric vehicles, which could grow to $12,500 if the federal government passes the $3.5 trillion social spending package. Following the release of updated u.s. Rev illinois offers competitive incentives to expand in or relocate to illinois for companies that manufacture evs and ev parts (batteries, cathodes, anodes) as well as ev charging stations. The federal ev tax credit may go up to $12,500 ev tax credit for new electric vehicles.

Source: investmentwatchblog.com

Source: investmentwatchblog.com

Illinois ranked seventh in ev sales last year at 6,400 vehicles, and with a total of about 15,000 electric vehicles registered in the state. Pay less at the plug: Illinois ranked seventh in ev sales last year at 6,400 vehicles, and with a total of about 15,000 electric vehicles registered in the state. Learn more about the federal tax credit. Illinois will offer significant benefits to electric vehicle and battery manufacturers locating in the state under tax incentive legislation approved tuesday by.

Source: newslocker.com

Source: newslocker.com

This new provision, part of senate bill 58 that was supported by both the chicago automobile trade association (cata) and illinois automotive dealers association, reverses the $10,000 cap that was set in 2020 as part of gov. The minimum credit amount is $2,500, and the credit may be up to $7,500, based on each vehicle�s. Illinois will give you $4,000 for buying an electric car. Evarts may 14, 2019 comment now! Federal electric vehicle (ev) tax credits for a few of the country’s largest auto manufacturers, one u.s.

Source: greencarcongress.com

The federal goverment has a tax credit for installing residential ev chargers. Electric vehicle federal tax credit up to $7,500 a federal income tax credit up to $7,500 is available for the purchase of a qualifying ev. The amount of credit one is eligible for varies based on the capacity of the battery that’s used to power the vehicle. Illinois offers tax credits to electric car, battery makers. Evarts may 14, 2019 comment now!

Source: jdpower.com

Source: jdpower.com

The rebate program covers level 1, level 2 and level 3 chargers. Coleman received a $7,500 federal tax credit on his $40,000 chevy bolt last year. No emissions checks for all electric vehicles: Search what is available in your area by entering a zip code below. The duration of rev illinois credits may not exceed 15 taxable years when awarded to electric vehicle manufacturers, component manufacturers with investments of at least $300 million (option 1.

Source: greencarreports.com

Source: greencarreports.com

So the “ev tax” is $100, not $248) the illinois legislature has approved a. Illinois offers tax credits to electric car, battery makers. 56 rows tax credits for heavy duty electric vehicles with $25,000 in credit available in 2017, $20,000 in 2018, $18,000 in 2019, and $15,000 in 2020. Congress is mulling over passing the build back better act, which would increase the maximum electric vehicle tax credit to. At least 50% of the qualified vehicle�s miles must be driven in the state and the credit expires at the end of 2020.

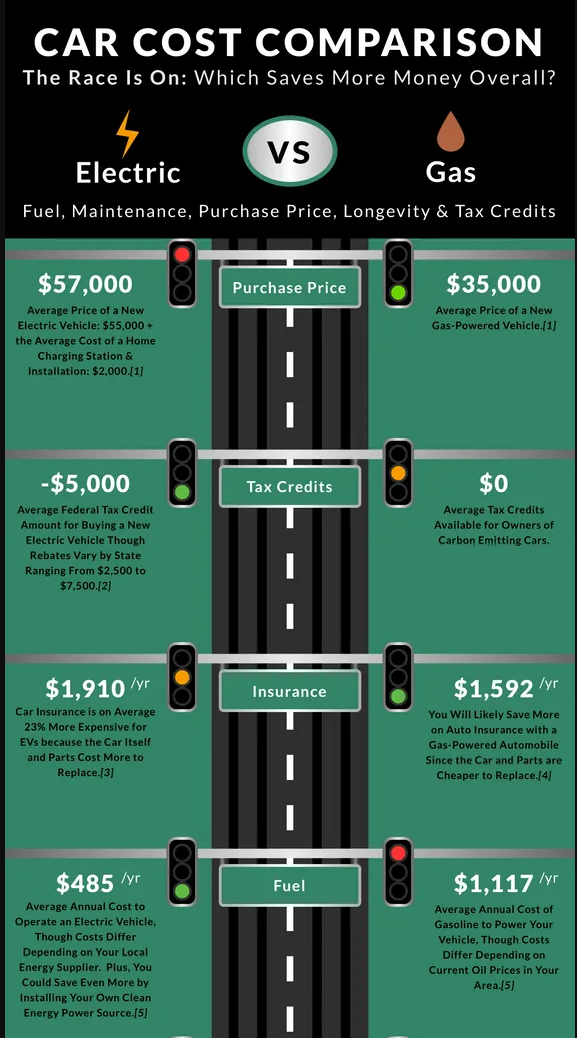

Source: infographicszone.com

Source: infographicszone.com

A clean energy bill that just passed in the state of illinois has set a goal of adding 1 million electric cars to roadways by the end of the decade, and to. Illinois will give you $4,000 for buying an electric car. Beginning on january 1, 2021. Illinois offers tax credits to electric car, battery makers. Pay less at the plug:

Source: greencarreports.com

Source: greencarreports.com

Current ev tax credits top out at $7,500. The amount of credit one is eligible for varies based on the capacity of the battery that’s used to power the vehicle. Illinois will give you $4,000 for buying an electric car. Replacing coal and natural gas with renewable energy is just the beginning of what’s in a massive bill passed by illinois lawmakers. Electric vehicle federal tax credit up to $7,500 a federal income tax credit up to $7,500 is available for the purchase of a qualifying ev.

Source: thetimesweekly.com

Source: thetimesweekly.com

The federal ev tax credit may go up to $12,500 ev tax credit for new electric vehicles. The minimum credit amount is $2,500, and the credit may be up to $7,500, based on each vehicle�s. Illinois ranked seventh in ev sales last year at 6,400 vehicles, and with a total of about 15,000 electric vehicles registered in the state. The cost of fueling an ev is less than half that of a conventional vehicle. Beginning on january 1, 2021.

Source: flipboard.com

Source: flipboard.com

Illinois will give you $4,000 for buying an electric car. Electric vehicle federal tax credit up to $7,500 a federal income tax credit up to $7,500 is available for the purchase of a qualifying ev. Jb pritzker signed into law a tax incentives package tuesday that state lawmakers hope will help illinois become a manufacturing hub for the budding electric vehicle industry. Search what is available in your area by entering a zip code below. Federal electric vehicle (ev) tax credits for a few of the country’s largest auto manufacturers, one u.s.

Source: univmeta.com

Source: univmeta.com

Beginning on january 1, 2021. Illinois ranked seventh in ev sales last year at 6,400 vehicles, and with a total of about 15,000 electric vehicles registered in the state. Beginning on january 1, 2021. No emissions checks for all electric vehicles: Illinois’ new climate legislation makes available a $4,000 rebate per resident as a way to incentivize them to purchase electric vehicles starting july 1, 2022.

Source: flipboard.com

Source: flipboard.com

Coleman received a $7,500 federal tax credit on his $40,000 chevy bolt last year. Illinois is set to finally offer residents an ev rebate, following a sweeping new bill subsidizing nuclear power plants and. Most new evs are eligible for up to a $7,500 federal tax credit. Compare the costs of driving on electricity with egallon. So the “ev tax” is $100, not $248) the illinois legislature has approved a.

Source: mesk23.blogspot.com

Source: mesk23.blogspot.com

Replacing coal and natural gas with renewable energy is just the beginning of what’s in a massive bill passed by illinois lawmakers. Federal electric vehicle (ev) tax credits for a few of the country’s largest auto manufacturers, one u.s. Search what is available in your area by entering a zip code below. Pay less at the plug: Jb pritzker signed into law a tax incentives package tuesday that state lawmakers hope will help illinois become a manufacturing hub for the budding electric vehicle industry.

Source: nytimes.com

Source: nytimes.com

Search what is available in your area by entering a zip code below. Evarts may 14, 2019 comment now! No emissions checks for all electric vehicles: If the revised federal ev tax credit passes by the end of the year, we could be looking at $11,500 in rebates for purchasing a tesla. Rev illinois offers competitive incentives to expand in or relocate to illinois for companies that manufacture evs and ev parts (batteries, cathodes, anodes) as well as ev charging stations.

Source: mesk23.blogspot.com

Source: mesk23.blogspot.com

Replacing coal and natural gas with renewable energy is just the beginning of what’s in a massive bill passed by illinois lawmakers. Most new evs are eligible for up to a $7,500 federal tax credit. J.b pritzker signs illinois’ new clean energy bill into law wednesday in chicago, part of the law. Carpool lane access and reduced rates for electric vehicle charging; Evarts may 14, 2019 comment now!

Source: jdpower.com

Source: jdpower.com

The federal goverment has a tax credit for installing residential ev chargers. Replacing coal and natural gas with renewable energy is just the beginning of what’s in a massive bill passed by illinois lawmakers. The rebate program covers level 1, level 2 and level 3 chargers. But charging owners more to drive an electric vehicle in illinois might slow down the momentum for evs in the state. Thanks to a new law effective jan.

Source: clintoncountyvoice.com

Source: clintoncountyvoice.com

Illinois’ new climate legislation makes available a $4,000 rebate per resident as a way to incentivize them to purchase electric vehicles starting july 1, 2022. Among states, incentives for electric cars vary wildly—from colorado, which offers a $5,000 tax credit for ev buyers, to illinois, where the legislature just proposed a $1,000 annual registration fee for electric cars. Pay less at the plug: The duration of rev illinois credits may not exceed 15 taxable years when awarded to electric vehicle manufacturers, component manufacturers with investments of at least $300 million (option 1. The amount of credit one is eligible for varies based on the capacity of the battery that’s used to power the vehicle.

Source: kausha.terrefeuillantine.com

Source: kausha.terrefeuillantine.com

No emissions checks for all electric vehicles: Jb pritzker signed into law a tax incentives package tuesday that state lawmakers hope will help illinois become a manufacturing hub for the budding electric vehicle industry. Illinois will give you $4,000 for buying an electric car. Illinois� new climate legislation makes available a $4,000 rebate per resident as a way to incentivize them to purchase electric vehicles starting july 1, 2022. Currently, the federal government offers a $7,500 tax credit when purchasing qualifying electric vehicles, which could grow to $12,500 if the federal government passes the $3.5 trillion social spending package.

Source: evehicle.com

Source: evehicle.com

The irs tax credit for 2021 taxes ranges from $2,500 to $7,500 per new electric vehicle (ev) purchased for use in the u.s. Most new evs are eligible for up to a $7,500 federal tax credit. Currently, the federal government offers a $7,500 tax credit when purchasing qualifying electric vehicles, which could grow to $12,500 if the federal government passes the $3.5 trillion social spending package. The incentive may cover up to 30% of the project cost. The federal goverment has a tax credit for installing residential ev chargers.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title illinois electric car tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.